nebraska sales tax percentage

Counties and cities in Nebraska are allowed to charge an additional local sales tax on. The Nebraska state sales and use tax rate is 55 055.

Nebraska Sales Tax Calculator And Local Rates 2021 Wise

The minimum combined 2022 sales tax rate for Omaha Nebraska is.

. Your account is not licensed to use an app that is not public. The base state sales tax rate in Nebraska is 55. The County sales tax rate is.

The 2018 United States Supreme. With local taxes the total sales tax rate is between 5500 and 8000. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75. This is the total of state county and city sales tax rates. Nebraska Sales Tax Rate Finder.

Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. The state sales tax rate in Nebraska is 55 but you can customize this table as needed to reflect your applicable local sales tax rate.

The Nebraska sales tax rate is currently. Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. The applicate tax rate for.

Nebraska has a 55 statewide sales tax rate but also has 337 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0832. The minimum combined 2022 sales tax rate for Aurora Nebraska is. 536 rows Nebraska Sales Tax55.

Nebraska has state sales tax of 55 and allows local governments to collect a local option sales tax of up. The Ashland sales tax rate is. Average Sales Tax With Local.

30 rows The state sales tax rate in Nebraska is 5500. Nebraska Non-motor Vehicle Sales Tax Collections by County and Selected Cities 19992021 Annual Non-motor Vehicle Sales Tax Collections Monthly Non-motor Vehicle Sales Tax. 50 rows Form Title Form Document Nebraska Tax Application with Information Guide 022018 20 Form 55 Sales and Use Tax Rate Cards Form 6 Sales and Use Tax Rate Cards.

In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees. Did South Dakota v. The Nebraska sales tax rate is currently.

The total tax rate might be as high as 75 percent depending on individual municipalities however food and. Nebraska has recent rate changes Thu Jul 01. Please ask your organization administrator to assign you a user type that includes Essential Apps or an.

The Nebraska sales tax rate is currently. The Nebraska NE state sales tax rate is currently 55. LB 873 reduces the corporate tax rate imposed on Nebraska taxable income in excess of 100000 for taxable years beginning on or after January 1 2024.

The Nebraska sales tax rate is currently. The current state sales tax rate in Nebraska NE is 55 percent. The minimum combined 2022 sales tax rate for Springfield Nebraska is.

Wayfair Inc affect Nebraska. This is the total of state county and city sales tax rates. This is the total of state county and city sales tax rates.

General Fund Receipts Nebraska Department Of Revenue

How To File And Pay Sales Tax In Nebraska Taxvalet

Wyoming 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Nebraska Income Tax Ne State Tax Calculator Community Tax

State And Local Sales Tax Deduction Remains But Subject To A New Limit Teal Becker Chiaramonte Certified Public Accountants

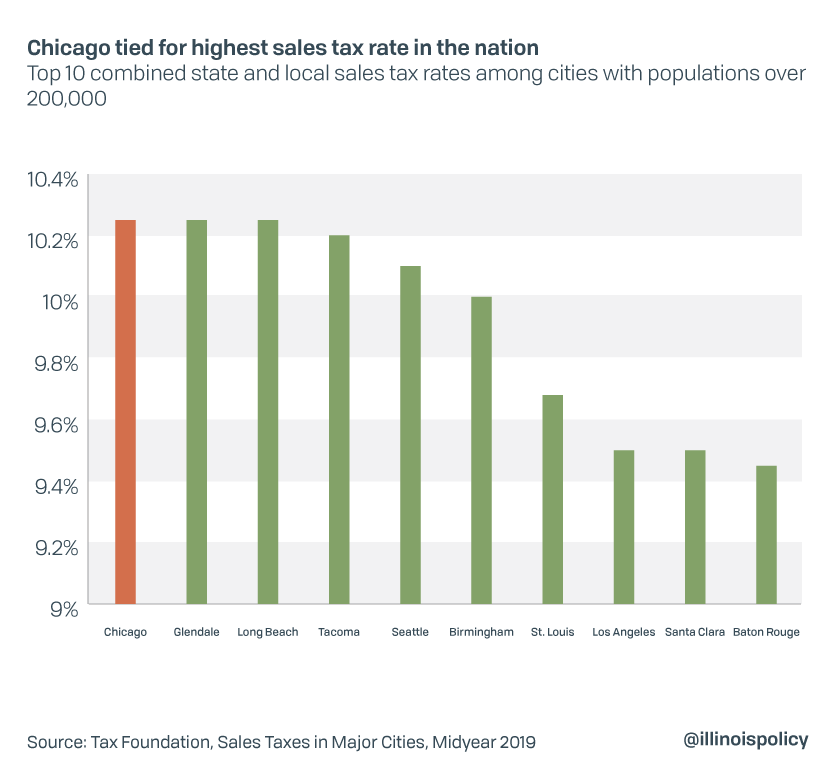

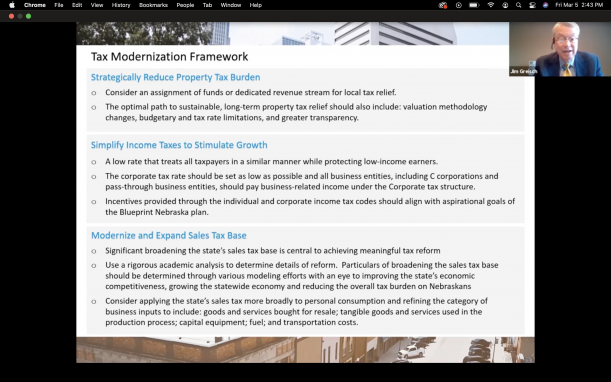

Blueprint Nebraska Outlines Tax Modernization Plan Omaha Daily Record

Nebraska Payroll Taxes A Complete Guide

Nebraska Income Tax Calculator Smartasset

Taxes And Spending In Nebraska

General Fund Receipts Nebraska Department Of Revenue

Sales Taxes In The United States Wikipedia

Nebraska Sales And Use Tax Nebraska Department Of Revenue

Sales Taxes In The United States Wikipedia

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Taxes And Spending In Nebraska

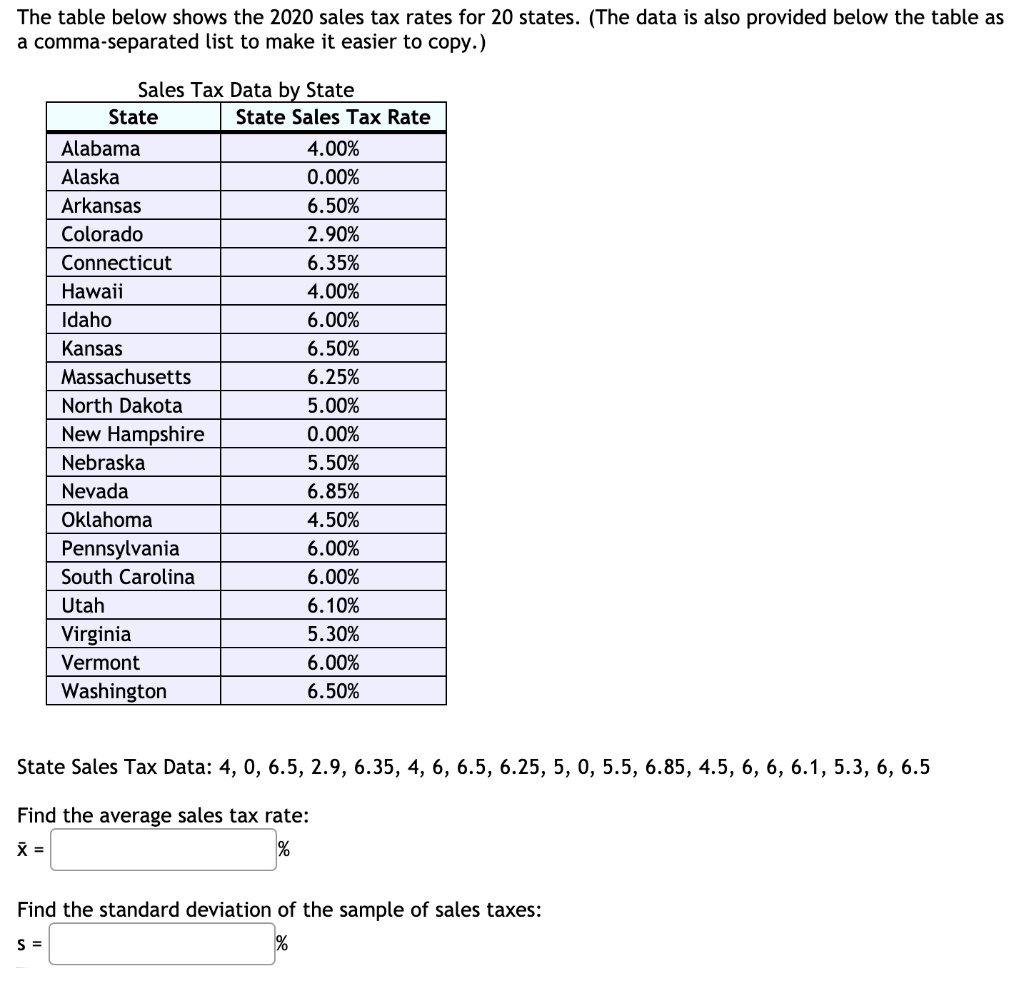

Solved Could You Help Me Figure Out What The Average Sales Chegg Com